Non-Profit Bookkeeping

Non-profit bookkeeping is one of the most complex types of bookkeeping. It is very different from small business bookkeeping, which you may be more familiar with. Managing the finances of a non-profit organization involves a unique set of challenges, including tracking multiple funding sources, ensuring compliance with donor restrictions, and providing detailed financial reports to stakeholders and regulatory bodies.

Understanding the Unique Challenges of Non-Profits

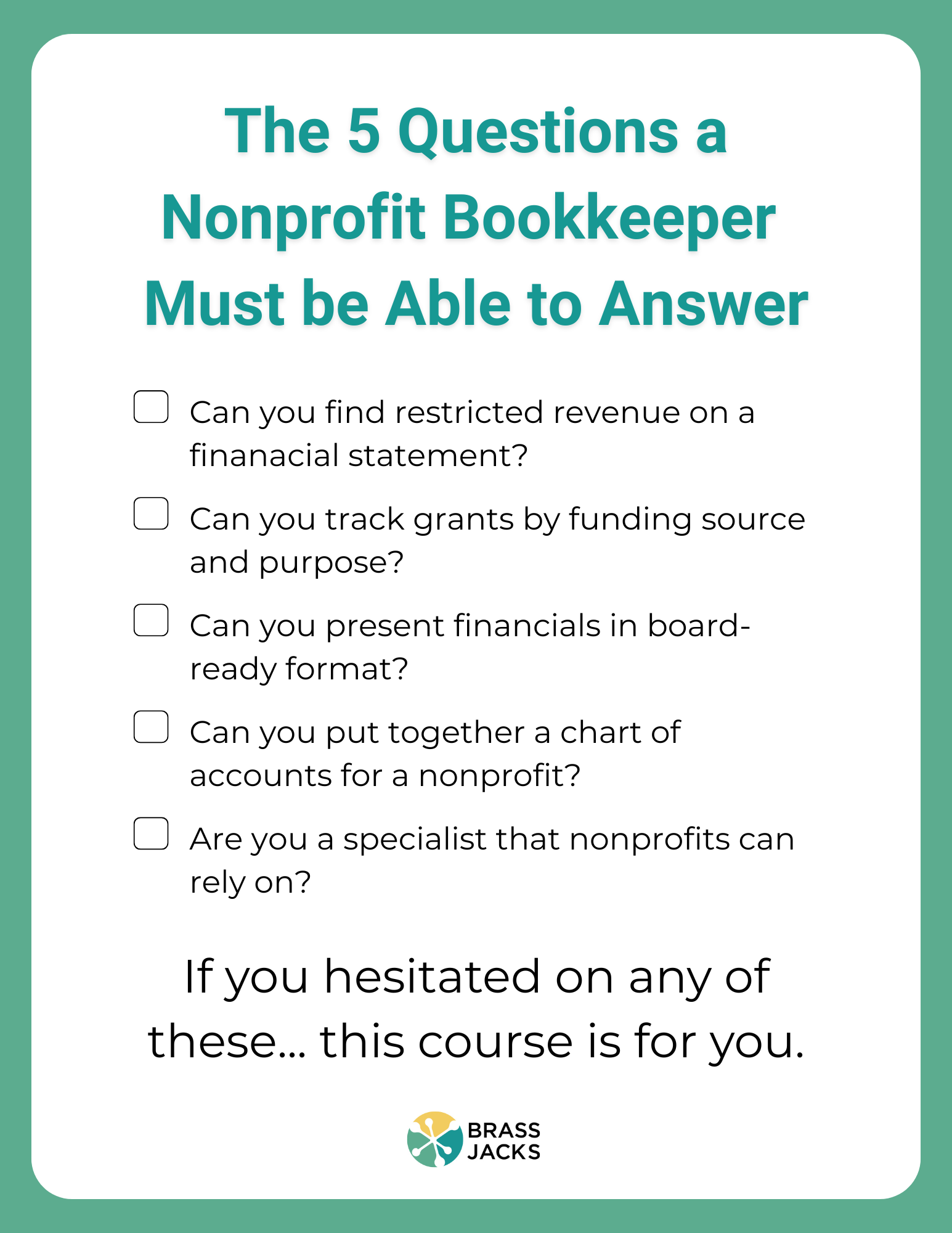

As a bookkeeper, you understand the importance of accurate financial management. However, non-profits operate under different rules and standards compared to for-profit businesses. From grant tracking to handling restricted revenue, the intricacies of non-profit bookkeeping require specialized knowledge and skills. Our course is designed to bridge that gap, equipping you with the expertise needed to navigate the complexities of non-profit financial management.

Understanding Non-Profits

In this class, you will learn how to create and maintain a chart of accounts tailored for non-profits, track program-specific revenue and expenses, and work effectively with a board of directors. These skills will not only enhance your proficiency as a bookkeeper but also empower you to make a meaningful impact on the financial health and sustainability of the non-profit organizations you serve.

Write your awesome label here.

THE DETAILS

What's included?

Let's take your bookkeeping skills to the next level.

Bookkeeping for non-profits is very rewarding when you know how to tie it all together (and have the tools to do so).

We have over 25 years of bookkeeping and accounting experience. We KNOW how it all ties together AND how to take care of the organization WITHIN the software.

This class is a 300 level course.

This class is a 300 level course.

Students should have a basic understanding of bookkeeping processes.

The Details

Whether you want to solidify your bookkeeping skills or you're starting from scratch, we've got you covered.

This course consists of 10 weeks of study.

You can expect to put in about 3 hours of work each week.

The majority of the course is taught via pre-recorded lessons so you can watch at your own convenience.

There is homework! You will be asked to do some research and some project based work.

There are also quizzes, tests and a final exam!

We take this education very seriously. You must put in the work necessary to pass the class.

Upon completion of the course you will receive the Brass Jacks seal of approval!

Student Feedback

I’ve been working with non-profits for over a decade, mostly self-taught. This course not only validated what I knew, but gave me better methods and checklists I now use with every client. The content around boards and communication? Game-changer.

Christee Sinclair

The Books!

The course was confirmation that the work I'm doing is important, and it showed me many areas in which I could improve, either by paying more attention to timelines (month-end, year-end, meeting schedules), or by asking better questions from my clients to get better data to track and report to them.

I came to this class having earned a Certificate in Nonprofit Management in the early 2010s, and I worked as a CFO for a nonprofit for 15 years. I still learned a LOT! I think this experience was very much worth it, even for someone with my experience.

I came to this class having earned a Certificate in Nonprofit Management in the early 2010s, and I worked as a CFO for a nonprofit for 15 years. I still learned a LOT! I think this experience was very much worth it, even for someone with my experience.

Cloudy Rockwell

Clear Solutions Accounting

I am really enjoying the non-profit bookkeeping class, it has helped me so much with my non-profit client.

Jamie Shuel

Wondering... Is this for me?

Meet Your Teacher...

Eastern Oregon University

I have worked in Accounting since 2007. I began teaching QuickBooks classes in 2012.

I LOVE to teach bookkeeping and accounting. Join me and see why so many people love to learn from me and my fun and engaging attitude!

This class is open for enrollment

Payment Plans Available

Frequently asked questions

Can I take this class with no bookkeeping experience?

This is an upper level course. Students should have at minimum a basic understanding of bookkeeping and accounting concepts. Students who are new to bookkeeping will need to put in the additional work to stay up to speed on the concepts taught during this course.

What is the Jackie Method?

Heck yes, we coined our own method!

The Jackie Method uses the 5 C's:

The Jackie Method uses the 5 C's:

- Consistent - The same expenses are coded to the same accounts time and time again

- Current - The books are up to date

- Correct - The data is entered correctly (need we say more?!)

- Concise - The financial reports are as short as possible - no fluff around here!

- Confidence - Most important! We want you to feel confident in the work you

do. Enough so that you feel comfortable answering questions management

has and saying “That’s a good question. Let me check on that.” Instead of

guessing or panicking.

How Can I Get A Discount?

We have intentionally left the cost of this comprehensive course lower than our other courses at this size in order to support non-profits. Therefore we are not offering any discounts at this time.

Is there a payment plan?

Yes! We want this course to be accessible. Payment plans are a great option and we offer them with no added cost to you.

Payment plans consist of three monthly payments of $600.

Payment plans consist of three monthly payments of $600.

Can you guarantee specific results?

We love this program and stand by what we teach. Our prior students have learned a lot from us and our clients are happy to work with us. However we have no way of knowing what you will do with this course and therefore cannot guarantee results, income or job opportunities. The testimonials on this page may not be typical for all students.

What is required to succeed in Non-Profit Bookkeeping?

- You will want to set aside approximately 3 hours of time each week for this course

- You will need access to a computer - the type of work you will be doing will require you to have access to a Mac or PC, a tablet or phone will not be sufficient for this course.

- Communication is key. This course is 10 weeks long for a good reason, it's an extremely robust course. Plan to ask questions and ask for help when you need it. We want all of our students to succeed so let us know how we can help you!

Investing in your bookkeeping...

...SAVES the company money

Some experts estimate that it costs around 1/3 of an employee's salary to replace them. However, it may cost up to even 3 or 4 times an employee's salary to replace them.

While the experts may disagree on the exact cost, training your current bookkeeper is far more cost effective than hiring a new one.

While the experts may disagree on the exact cost, training your current bookkeeper is far more cost effective than hiring a new one.

...Empowers Your Employees

Your bookkeeper wants to do their job well. There's nothing worse than trying to do a job that you're not properly trained for!

If an employee is not getting proper professional development, they will likely be frustrated and look for a job elsewhere, where they feel more valued.

If an employee is not getting proper professional development, they will likely be frustrated and look for a job elsewhere, where they feel more valued.

...Increases Revenue

Investing in your team improves your company's credibility and efficiency. Both are key pieces to generating more revenue.

Write your awesome label here.

Providing your bookkeeper professional development is an easy decision

If you're a bookkeeper of a nonprofit organization, we made you a downloadable pdf you can provide your manager or ED explaining why it's beneficial to invest in you!